Fraud Alert Detection System

Streamlining Credit Application Review

Overview

Led the UX team for a new fraud detection workflow within a credit company's internal system. The project aimed to replace manual, multi-system processes with an integrated, step-by-step disposition flow that would help accountants efficiently review credit applications and respond to fraud alerts.

NOTE: Project details have been modified to protect confidential business information.

Problem Statement

Credit application reviewers were experiencing significant inefficiencies in their fraud detection process. When applicants applied for credit, accountants had to manually check names across multiple disconnected systems—a process known internally as "swivel chair" work.

While the company had recently implemented a new fraud detection system capable of communicating with the existing intranet, there was no clear workflow to guide users through the disposition process. This resulted in:

Time-consuming manual cross-referencing between systems

Inconsistent review processes

Risk of missing critical fraud indicators

User confusion about process steps and decision points

My Role:

Lead UX Designer

Timeline:

4 weeks

Team:

3 UX Designers

1 Business Analyst

Development Team

2 Project Managers

Research & Discovery

Understanding the Current State

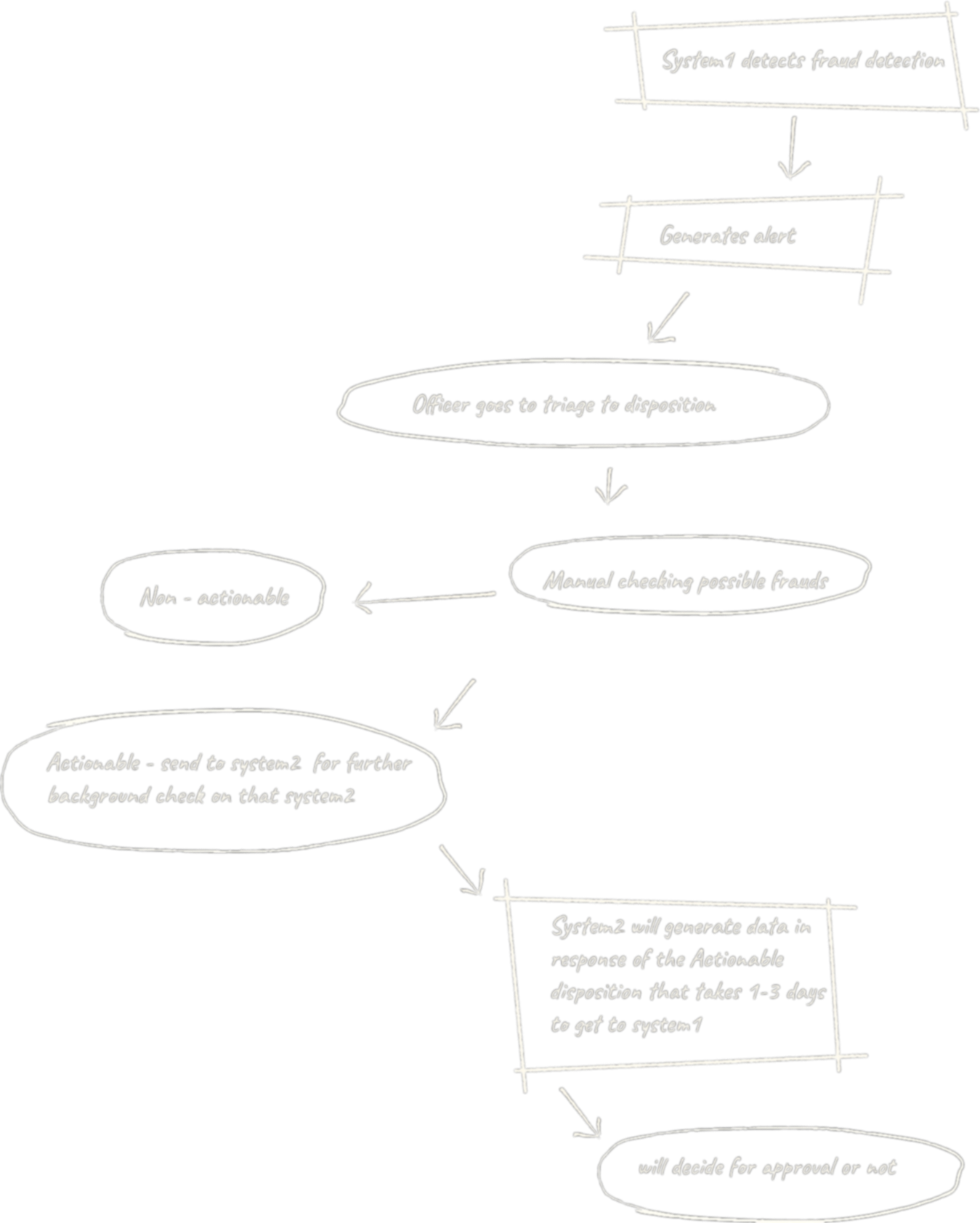

Mapped the existing process flow to understand how accountants currently handle fraud alerts. This revealed a complex ecosystem where users had to:

Receive fraud alerts from the new detection system

Cross-reference applicant information across multiple databases

Make disposition decisions without clear guidance

Navigate between two distinct workflow paths:

actionable alerts requiring investigation and

non-actionable alerts requiring acknowledgment

Stakeholder Collaboration

Working closely with the Business Analyst was crucial to this project's success. She had extensive domain knowledge and initial interface concepts, but we were able to identify opportunities to improve the user experience while achieving business objectives.

Through collaborative design sessions, I was able to demonstrate how alternative approaches could better serve both user needs and business requirements.

System Architecture Analysis

One of the biggest challenges was understanding how the various systems communicated with each other. A collaboration with the development team and Business Analyst to map out:

Data fields required to adjudicate

Technical constraints

Business rules governing different alert types

User decision points and their downstream effects

Design Process

Information Architecture

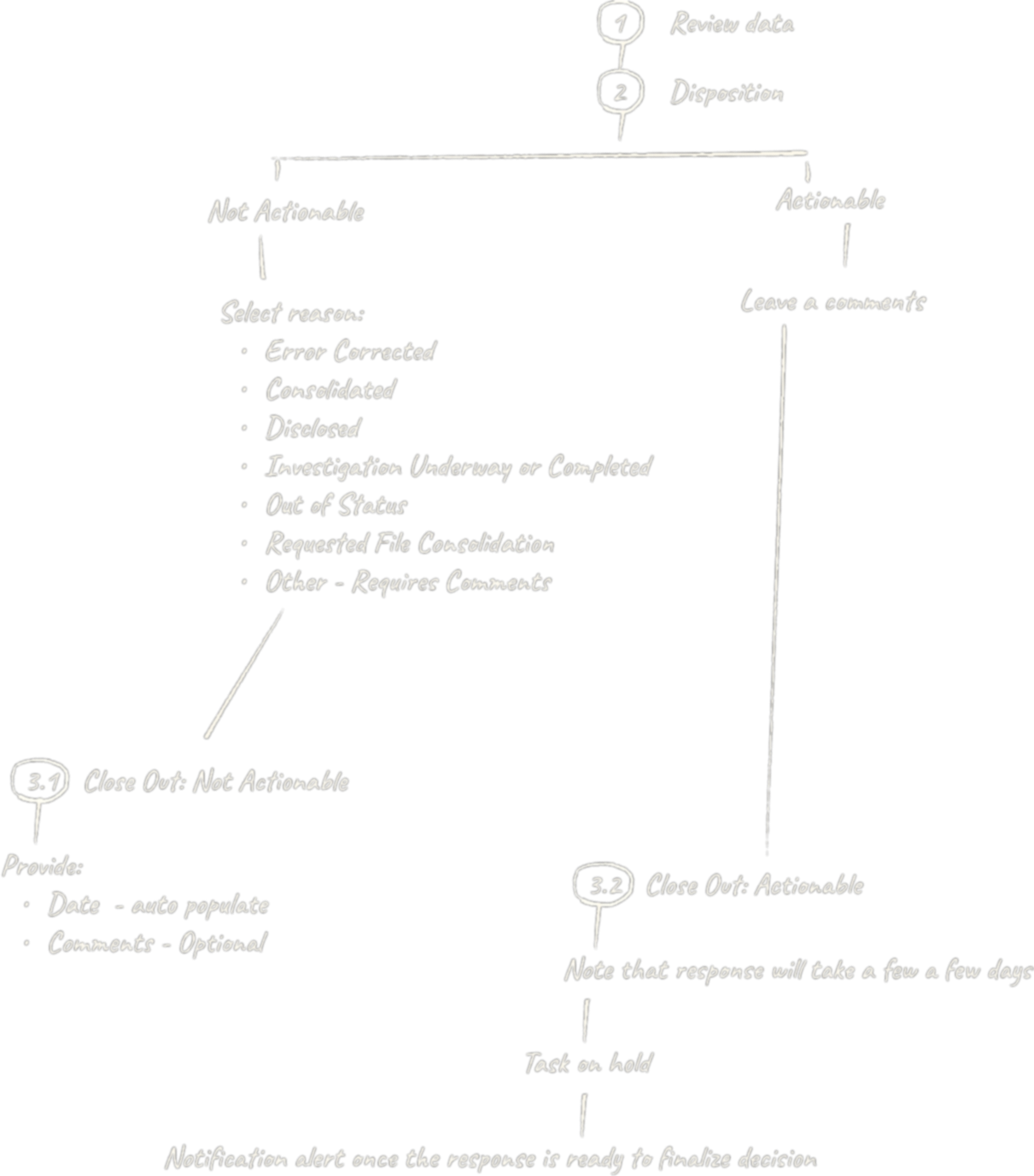

Created a comprehensive system map showing how different components would work together:

Alert Classification

Automatic routing based on fraud detection system output

Progressive Workflow

Step-by-step process that adapts based on alert type

Decision Trees

Clear paths for actionable vs. non-actionable scenarios

User Flow Design

The core challenge was designing for two distinct cognitive modes:

Investigation Flow: For actionable alerts requiring detailed analysis and likely leading to application denial

Verification Flow: For non-actionable alerts requiring acknowledgment before approval

Key Design Principles

Clear Progress Indication: Users needed to understand where they are in the process at all times, especially while waiting for data to be pulled from the other system.

Contextual Interface: The system would show only relevant information based on the action required.

System Integration: Seamless incorporation of fraud detection system data while maintaining familiar intranet patterns.

Error Prevention: Built-in safeguards to ensure critical steps weren't skipped in either workflow path.

Design Solution

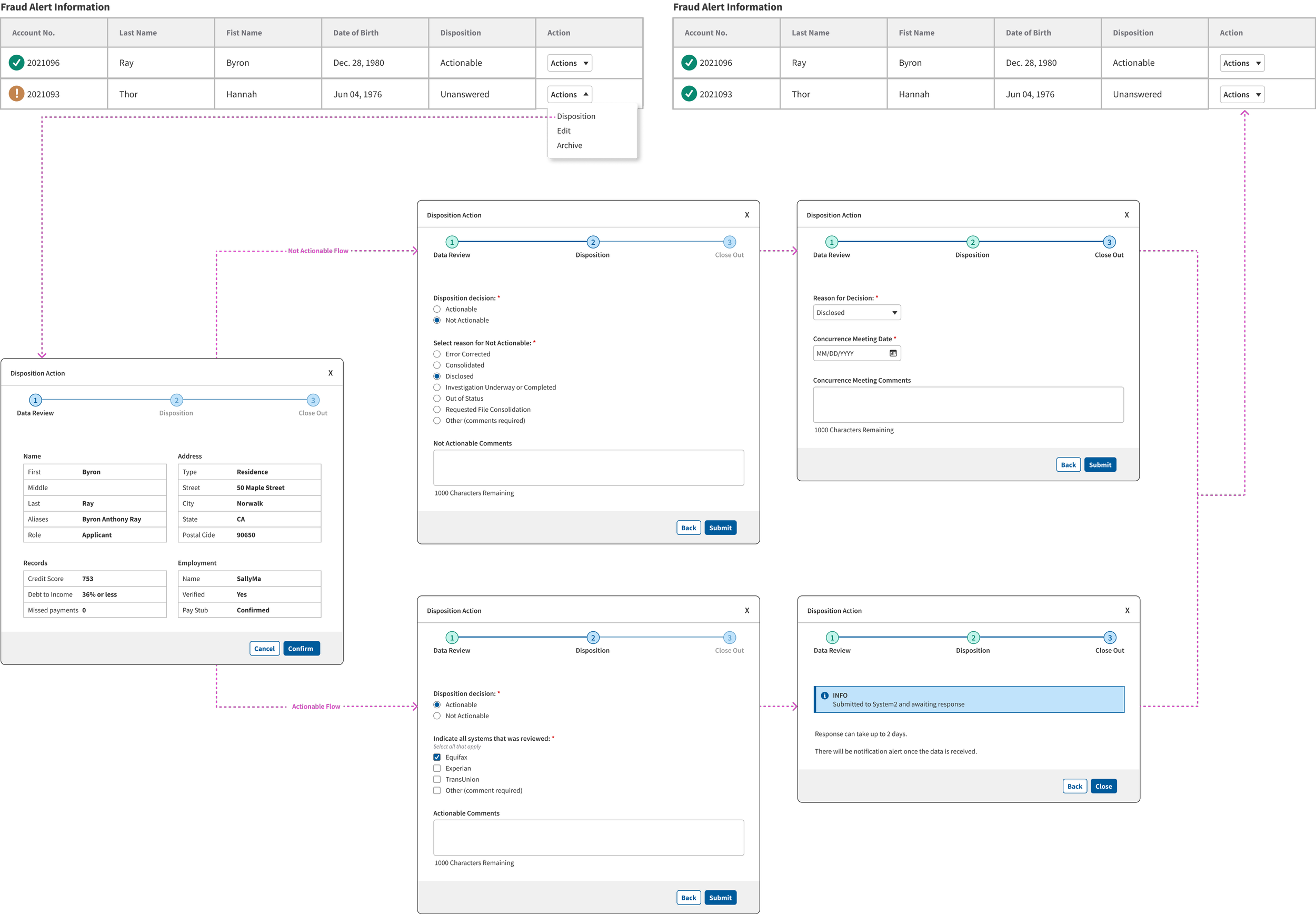

Step-by-Step Disposition Process

Designed a stepper workflow for fraud detection, providing clear navigation through complex decision trees. The interface adapts based on action type and tapping in the notification alert to notify users when data is ready.

Integrated System Communication

The solution leverages the new fraud detection system's capabilities while maintaining consistency with existing intranet patterns. Data flows seamlessly between systems, eliminating the need for manual cross-referencing.

Progressive Disclosure

Rather than overwhelming users with all possible actions upfront, the interface reveals options progressively based on:

Mark as reviewed page

Alert classification (actionable/non-actionable)

Previous decisions made in the case

Adaptive Workflows

The interface intelligently routes users through appropriate processes:

Actionable alerts guide users through investigation steps with additional verification requirements

Non-actionable alerts streamline the acknowledgment process for faster case resolution

Stakeholder Feedback & Iteration

The Business Analyst's response was particularly validating. Despite having her own initial interface concept, she embraced the new design approach after seeing how it addressed user pain points while meeting business requirements. Her endorsement was crucial for gaining broader organizational buy-in.

The collaborative process demonstrated the value of challenging initial assumptions while maintaining strong working relationships with domain experts.

Results & Impact

The new fraud detection workflow transformed the credit application review process by:

Eliminating "swivel chair" inefficiencies through integrated system communication

Reducing cognitive load with clear process guidance and contextual interfaces

Improving decision consistency through standardized workflow steps

Decreasing processing time for both actionable and non-actionable items

Increasing user confidence in handling complex fraud scenarios

Key Takeaways

Systems Thinking

Complex integrations require a thorough understanding of data flows and business rules before designing interfaces.

Collaborative Influence

Sometimes the best solutions emerge from respectfully challenging stakeholder assumptions while staying open to their domain expertise.

User-Centered Business Logic

Effective enterprise software balances business requirements with cognitive ergonomics for the people using the system daily.

Progressive Disclosure

In complex workflows, revealing information and actions contextually prevents user overwhelm and reduces errors.